Your Customer-to-Cash Cycle. Supercharged.

The entire customer lifecycle starts here.

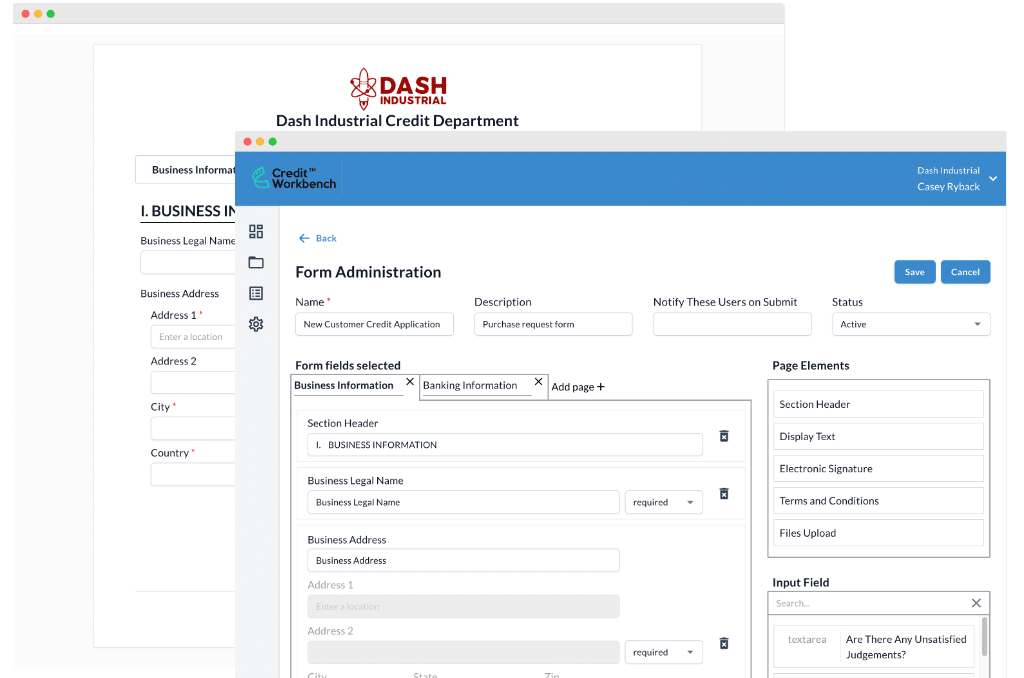

Better B2B collections begin with a better credit application. Streamlined credit decisions and onboarding turn prospects into paying customers faster. The onboarding process for a new customer only happens once, but the customer credit relationship is forever.

As the foundation of the customer-to-cash cycle, a superior credit application sets the tone for the entire customer relationship and sets the stage for faster, more productive collections down the road.

Why Credit Workbench

Boost collections by simplifying and securing your credit workflow.

Your customers obtain capital from three sources: equity, funded debt, and their trade vendors. In times of financial stress, vendors become the lenders of last resort. As a result, commercial trade credit comprises an ever-growing portion of total corporate capital. In an uncertain global economy, the ability to securely gather, organize, and store customer credit information is more important than ever. With Credit Workbench, that process starts at the credit application and continues through the entire customer lifecycle.

Nobody wants a credit customer to default, but the reality is that some defaults are inevitable. Credit Workbench helps you reduce the risk of customer defaults, but also helps you better prepare for customer delinquency, collection efforts (both first- and third-party), collection litigation, customer bankruptcy, and preference defense.